Creating Budgets and Financial Models in Excel

Excel is a powerful tool for creating budgets and financial models that help you manage your finances more effectively. Whether you’re planning for personal expenses or developing complex financial projections for a business, Excel offers a variety of features that simplify the process.

Creating a Budget

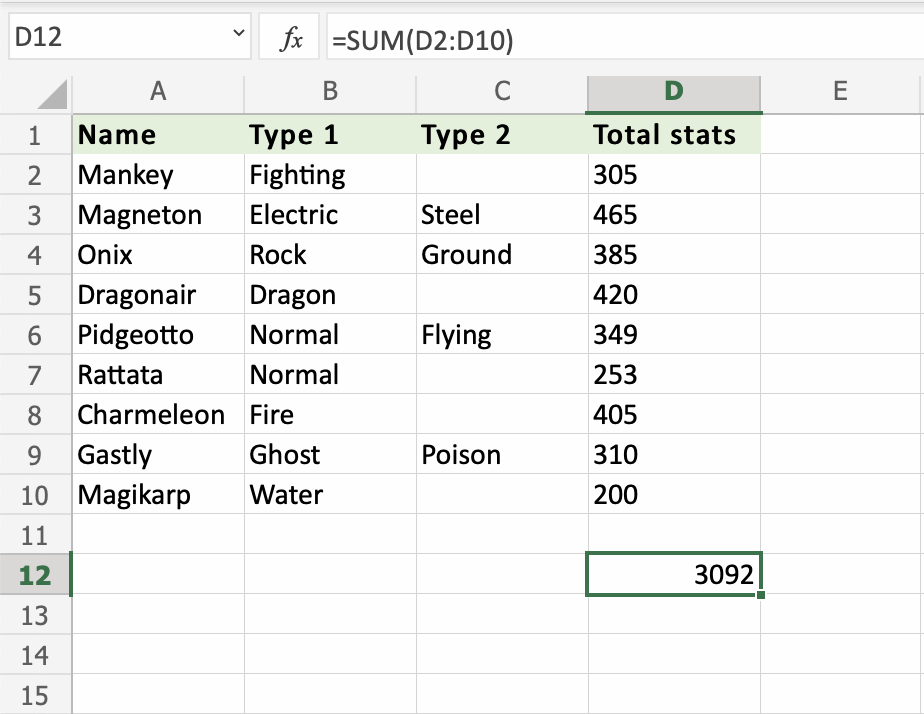

A budget is an essential tool for managing your income and expenses. Excel allows you to input income, track expenses, and analyze financial data through its powerful spreadsheet functions. By using Excel, you can easily visualize your financial health and make adjustments as needed.

Building Financial Models

Financial models in Excel are essential for forecasting and making strategic decisions. You can create income statements, balance sheets, and cash flow statements using functions like SUM, VLOOKUP, and pivot tables. These models help analyze different scenarios and provide insights into business performance.

Key Features for Budgets and Models

- Formulas and Functions: Utilize formulas like IF, SUM, AVERAGE, and COUNT to perform calculations.

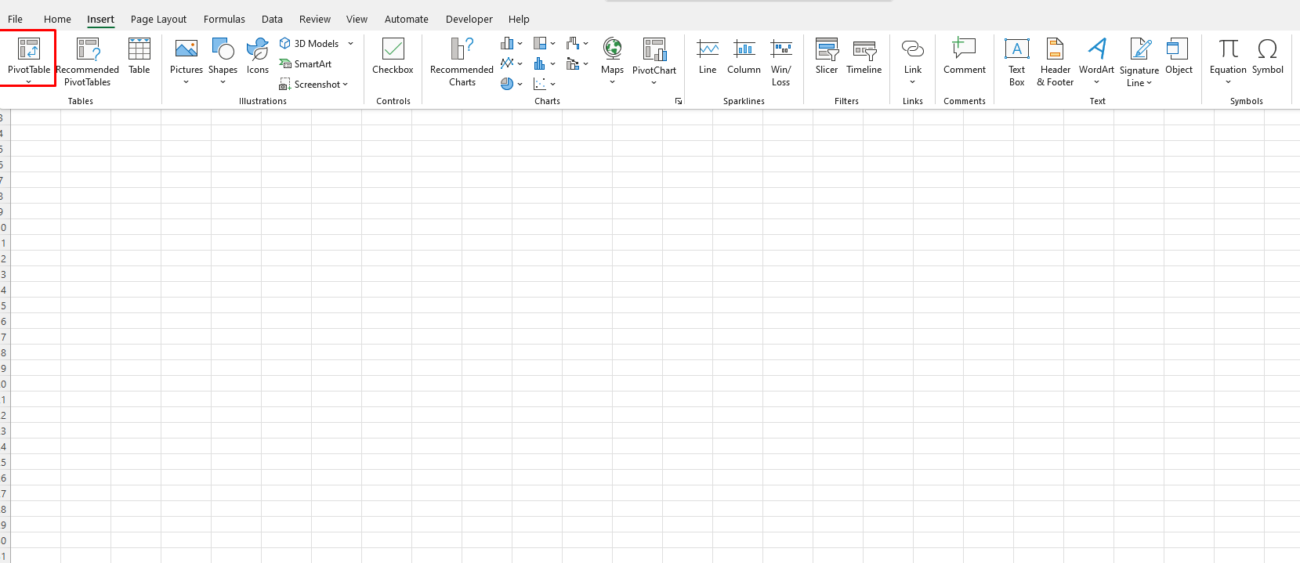

- PivotTables: Summarize and analyze large datasets efficiently.

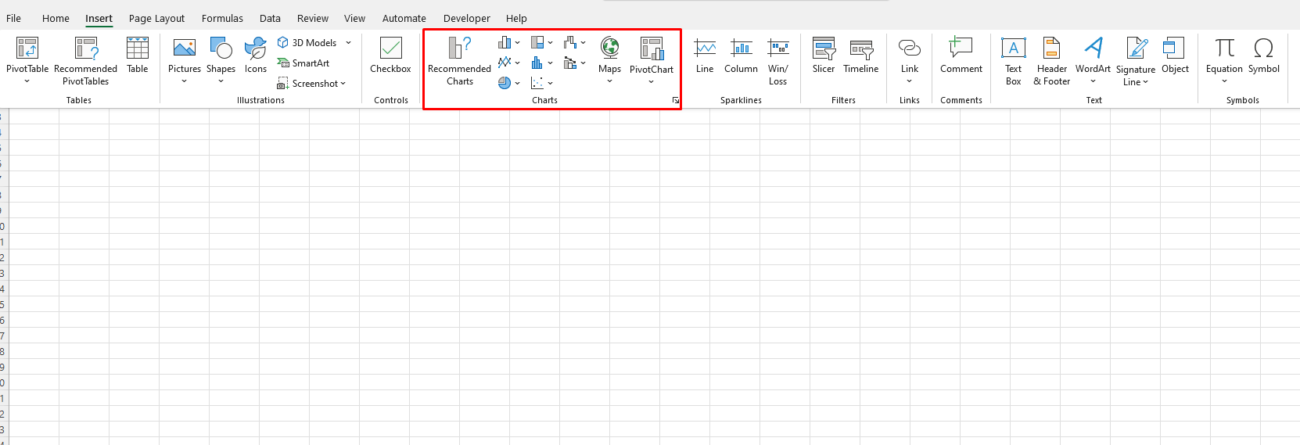

- Data Visualization: Create charts and graphs to visualize financial data for better decision-making.

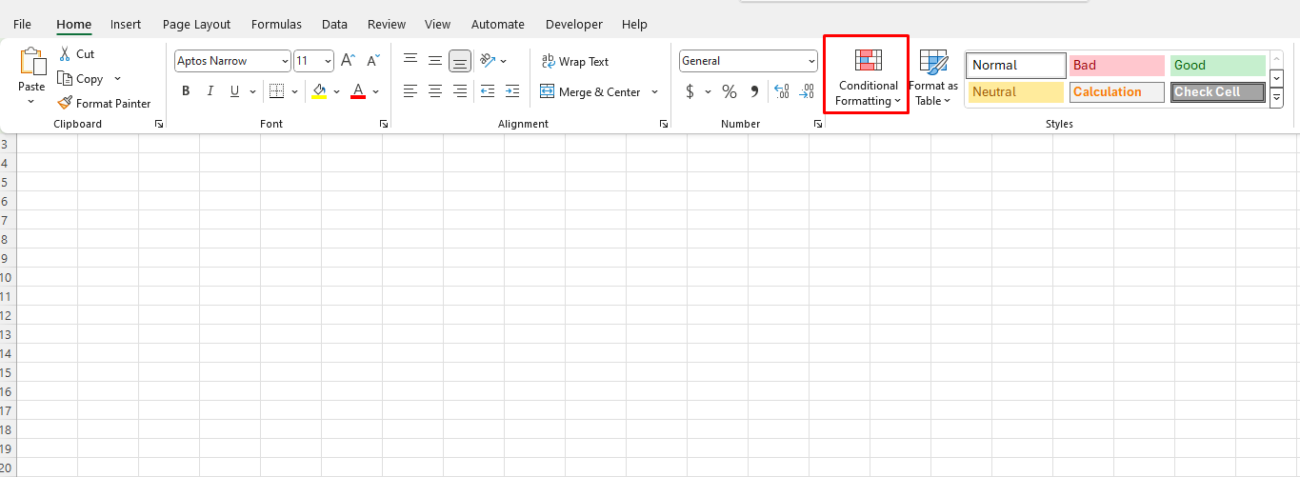

- Conditional Formatting: Highlight key data points for quick analysis.

Get your cheap Office keys now and unlock powerful productivity tools at an unbeatable price!