When it comes to financial planning, especially for loans or investments, calculating your periodic payments is crucial. One of the most powerful tools for this in Excel is the PMT function. Whether you’re working out your monthly mortgage payments, planning car loan repayments, or setting savings goals, Excel’s PMT formula can simplify the process.

In this guide, we’ll explain how to use the PMT function in Excel to calculate loan payments and show how it can support your financial planning.

What is the PMT Formula?

The PMT formula in Excel is used to calculate the periodic payment amount for a loan or investment based on constant payments and a fixed interest rate. It’s especially helpful when managing mortgages, car loans, student loans, or regular investment contributions.

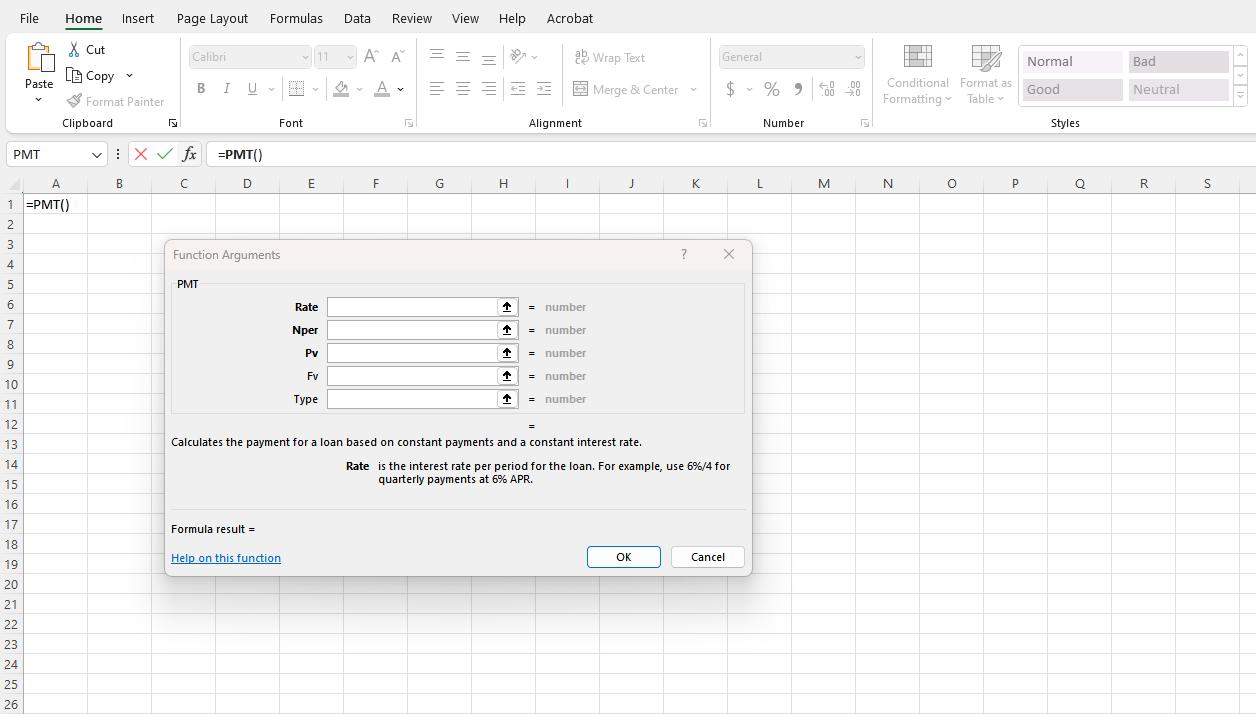

PMT Formula Syntax in Excel:

=PMT(rate, nper, pv, [fv], [type])- rate: The interest rate for each period.

- nper: The total number of periods (months, years, etc.).

- pv: The present value or loan amount (principal).

- fv (optional): The future value, or the amount left after the last payment (default is 0).

- type (optional): Specifies when the payment is due (0 = end of the period, 1 = beginning).

How to Use the PMT Function to Calculate Loan Payments

Let’s go through an example to show how easy it is to calculate monthly loan payments using the PMT formula.

Example: Calculating Monthly Payments for a Loan

Imagine you’re taking out a €20,000 loan to buy a car. The annual interest rate is 5%, and you plan to pay off the loan over 5 years (60 months). Here’s how to calculate your monthly payments in Excel using the PMT formula:

Step-by-Step Guide:

- Open Excel and click on a cell where you want to display the result.

- Enter the following formula:

=PMT(5%/12, 60, -20000)- 5%/12: This converts the annual interest rate to a monthly rate (5% divided by 12).

- 60: The total number of payments (5 years × 12 months).

- -20000: The present value or loan amount (entered as a negative number because it represents an outgoing payment).

For this example, the monthly payment would be €377.42.

Adjusting the PMT Formula for Different Scenarios

The PMT function is highly flexible. Here are some adjustments you can make for different financial scenarios:

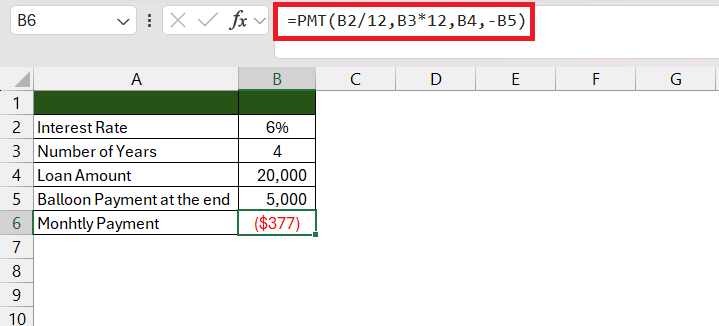

1. Accounting for Future Value (Balloon Payments)

If you want to leave a balance at the end of the loan term (e.g., a balloon payment of €5,000), you can include the fv argument:

excelCopy code=PMT(5%/12, 60, -20000, 5000)This will calculate your monthly payments while considering the remaining €5,000 balance at the end of the term.

2. Adjusting Payment Timing

By default, Excel assumes payments are made at the end of each period. If you are making payments at the beginning of each period (e.g., beginning of the month), include the type argument as 1:

excelCopy code=PMT(5%/12, 60, -20000, 0, 1)This formula will calculate payments assuming they’re due at the start of each period.

Real-Life Applications of the PMT Function

The PMT formula can be used for various financial calculations:

- Mortgages: Determine your monthly mortgage payments based on the loan amount, interest rate, and loan term.

- Car Loans: Use the formula to plan your car loan repayments and ensure they fit your budget.

- Student Loans: Plan your student loan repayments over a given term and fixed interest rate.

- Savings Goals: Reverse the process to determine how much you need to save each month to reach a future financial goal (by adjusting the pv to represent how much you want to accumulate).

Common Mistakes to Avoid

- Using the Wrong Interest Rate: Remember to convert the annual interest rate to match the payment period. For example, if your payments are monthly, divide the annual interest rate by 12.

- Incorrect Periods: Ensure that the number of periods (nper) corresponds to the payment frequency. For monthly payments over 5 years, it should be 60, not 5.

- Negative Present Value: Always input the loan amount (pv) as a negative value since it represents an outgoing payment.

Benefits of Using the PMT Function for Financial Planning

- Accuracy: By automating the calculation, you reduce the risk of manual errors.

- Time-Saving: Quickly calculate payment schedules without complex manual calculations.

- Scalability: Easily adjust variables like loan amounts, interest rates, or terms to see how they affect your payments.

- Flexibility: Use the formula for various types of financial decisions, whether for loans or savings.

Looking for an affordable, genuine lifetime license for Office? We’ve got you covered! Find original licenses for Office 2021, 2019, 2016, and more at great prices.