When working with complex formulas in Microsoft Excel, it is crucial to ensure their accuracy and troubleshoot any errors that may occur. Excel provides robust tools and functionalities for formula auditing and error checking, enabling users to identify and resolve issues efficiently. In this guide, we will explore how Excel handles formula auditing and error checking, empowering users to maintain the integrity of their calculations and minimize the likelihood of errors.

Excel offers various features for formula auditing, including the ability to trace precedents and dependents. By using these tools, users can understand the relationships between cells and formulas, helping them identify any potential sources of errors or inconsistencies. Additionally, Excel provides the Evaluate Formula feature, which allows users to step through complex formulas and observe the results of each calculation, helping to pinpoint any errors in logic or calculations. Furthermore, Excel’s Error Checking feature automatically detects common errors, such as circular references or inconsistent formulas, and provides suggestions for resolution.

Step 1: Open Microsoft Excel:

- Launch Microsoft Excel on your computer.

- If you don’t have Excel installed, you can download it from the official Microsoft website.

Step 2: Enter Formulas:

- Enter formulas into your Excel worksheet.

- Begin typing directly into the desired cell, starting with an equal sign (=) to indicate a formula.

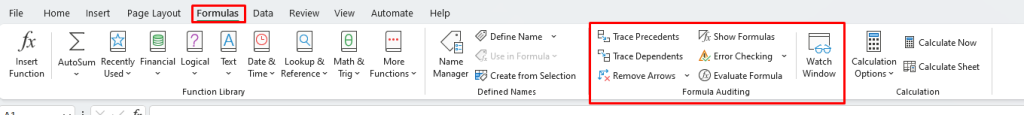

Step 3: View Formula Auditing Toolbar:

- Go to the Formulas tab in the Excel ribbon.

- Click on “Formula Auditing” to view the Formula Auditing toolbar.

Step 4: Trace Precedents:

- Select the cell containing the formula you want to trace.

- Click on “Trace Precedents” in the Formula Auditing toolbar.

- Excel will display arrows pointing to the cells referenced in the formula.

Step 5: Trace Dependents:

- Select the cell for which you want to trace dependents.

- Click on “Trace Dependents” in the Formula Auditing toolbar.

- Excel will display arrows pointing to cells dependent on the selected cell.

Step 6: Evaluate Formulas:

- Select the cell with the formula you want to evaluate.

- Click on “Evaluate Formula” in the Formula Auditing toolbar.

- Excel will show a step-by-step evaluation of the formula, highlighting each calculation.

Step 7: Error Checking Options:

- Excel automatically checks for formula errors, but you can customize the error checking options.

- Go to the File tab, select “Options,” then choose “Formulas.”

- Enable or disable specific error checking options based on your preferences.

Step 8: Error Checking Indicator:

- Excel uses an error checking indicator to flag potential formula errors.

- When an error is detected, a small green triangle appears in the top-left corner of the cell.

- Clicking on the triangle provides options for error checking and resolving the issue.

Step 9: Error Checking Formula:

- Click on the cell with the error indicator.

- Excel will display a drop-down menu with suggested actions for resolving the error.

- Choose the appropriate option to correct the formula error.

Step 10: Use Error Functions:

- Excel offers error functions to handle formula errors in a systematic manner.

- Utilize functions like IFERROR, ISERROR, and ISERR to handle and display custom messages for specific errors.

This step-by-step guide has covered key functions such as tracing precedents and dependents, evaluating formulas, customizing error checking options, using error checking indicators, and implementing error functions.

Unlock the full potential of productivity by purchasing Microsoft Office on our website at the lowest price available, ensuring you get the best deal for essential office tools.