Are you looking to make financial decisions and evaluate investment opportunities? The NPV function is Excel is here to help you. The Net Present Value (NPV) function is a powerful tool that allows you to calculate the present value of cash flows and assess the profitability of projects. By understanding how to use the NPV function in Excel, you can enhance your financial analysis capabilities and make data-driven decisions.

In this comprehensive guide, we will break down the process of using the NPV function step by step, providing clear instructions and examples along the way. Whether you are a finance professional, a business owner, or a student studying financial analysis, this guide will equip you with the knowledge and skills to leverage the NPV function in Excel effectively.

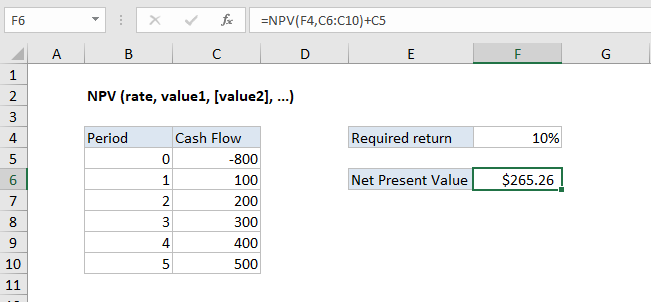

Step 1: Understanding the Syntax

Before utilizing the NPV function, it’s essential to comprehend its syntax. The syntax for the NPV function is as follows:

NPV(rate, value1, [value2], …)

- rate: The discount rate that represents the interest rate for the time period.

- value1, value2, …: The cash flow values to be discounted.

Step 2: Organizing Your Data

To effectively use the NPV function, you need to organize your data. Arrange your cash flow values in chronological order, typically in column A.

Step 3: Enter the NPV Function

In an empty cell, enter “=NPV(“, followed by the discount rate (rate) input, and a comma to separate the arguments.

For example, if your discount rate is 10% and your cash flow values are in cells A1 to A5, the formula would look like this: “=NPV(0.10, A1:A5“

Step 4: Closing the Function

Close the function with a closing parenthesis “)” and press Enter. Excel will then calculate the NPV based on the provided cash flow and discount rate.

Step 5: Interpreting the Results

The result of the NPV function will be displayed in the cell where you entered the formula. A positive NPV indicates that the investment is expected to generate a profit, while a negative NPV suggests the investment is likely to result in a loss. The magnitude of the NPV value signifies the project’s potential profitability.

Step 6: Evaluating Investment Decisions

Use the calculated NPV value to make informed investment decisions. If you have different investment options, compare their NPV values to determine which project is more financially viable.

By following these step-by-step instructions, you can effectively utilize the NPV function to evaluate cash flows, calculate net present value, and make informed financial decisions.

Discover unbeatable prices on genuine Office keys when you purchase from our website, ensuring you get the lowest price for all your software needs.